18

September 2013

Past Event

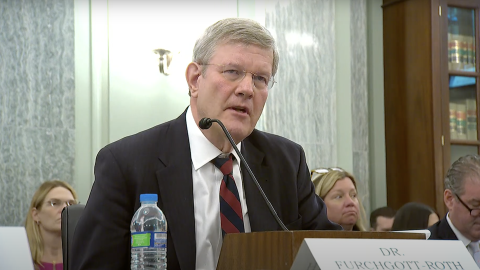

IRS + 501(c)(4) = SOS?

IRS + 501(c)(4) = SOS?

Past Event

Hudson Institute, Washington, D.C. Headquarters

September 18, 2013

Share:

Related Events

26

April 2024

Virtual Event | Online Only

South Africa’s Historic Election: A Conversation with Inkatha Freedom Party National Spokesperson Mkhuleko Hlengwa

Featured Speakers:

Mkhuleko Hlengwa

Joshua Meservey

26

April 2024

Virtual Event | Online Only

South Africa’s Historic Election: A Conversation with Inkatha Freedom Party National Spokesperson Mkhuleko Hlengwa

Mkhuleko Hlengwa will offer insights into the IFP’s governing philosophy, its perspective on foreign policy, and its assessment of the impending national elections.

Featured Speakers:

Mkhuleko Hlengwa

Joshua Meservey

29

April 2024

In-Person Event | Hudson Institute

Latin America’s Foreign Policies at a Crossroads

Featured Speakers:

Hector Schamis

Daniel Batlle

29

April 2024

In-Person Event | Hudson Institute

Latin America’s Foreign Policies at a Crossroads

Join Hudson for a conversation with academic and columnist Hector Schamis on how Latin American governments’ approach to foreign policy destabilizes the region.

Featured Speakers:

Hector Schamis

Daniel Batlle

30

April 2024

In-Person Event | Hudson Institute

Northern Europe, NATO, and the War in Ukraine: A Conversation with Lithuanian Minister of Defense Laurynas Kasčiūnas

Featured Speakers:

Laurynas Kasčiūnas

Peter Rough

Tomas Janeliūnas

30

April 2024

In-Person Event | Hudson Institute

Northern Europe, NATO, and the War in Ukraine: A Conversation with Lithuanian Minister of Defense Laurynas Kasčiūnas

Join Hudson Institute’s Peter Rough as he sits down with Lithuania’s minister of defense, Laurynas Kasčiūnas.

Featured Speakers:

Laurynas Kasčiūnas

Peter Rough

Tomas Janeliūnas

09

May 2024

In-Person Event | Hudson Institute

Keeping the Republic: A Defense of American Constitutionalism

Featured Speakers:

Mark Landy

Dennis Hale

Moderator:

Rachel Mackey