Africa struggles to climb American policymakers’ priority list, but it has no such problem with China.

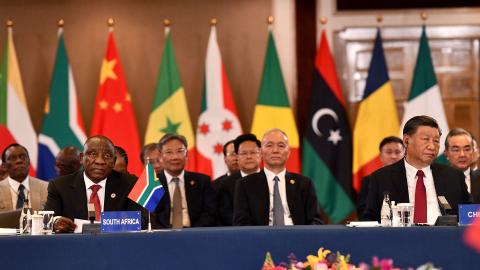

For three decades, the Chinese government has expended immense energy courting African countries. With only two exceptions over the last thirty years, the Chinese foreign minister has made Africa his first overseas destination every year. Other senior Chinese officials frequently call on their African counterparts, visits reciprocated by an annual parade of senior Africans to Beijing (former Namibian president Sam Nujoma visited 17 times). President Xi Jinping has visited Africa five times throughout his tenure, including traveling to South Africa in August for a state visit and to attend the BRICS summit, only the second overseas trip he has taken this year amid escalating domestic challenges.

China is now Africa’s largest bilateral trade partner and creditor. An estimated 10,000 Chinese companies operate on the continent, some of which dominate certain industries. Last year, for example, Chinese firms won nearly a third of all African infrastructure contracts worth more than $50 million.

At least one million Chinese expatriates live in Africa, according to estimates, while tens of thousands of young Africans study in China on Chinese government scholarships every year. Beijing also deploys an array of other cultural, economic, and, increasingly, military initiatives to charm the continent.

To understand why the world’s second-largest economy and aspiring superpower courts Africa, it is necessary to understand the aim of the Chinese Communist Party (CCP), which controls the Chinese government, to return China to what it sees as its rightful place, an unchallengeable global power. This goal is embedded within Xi’s “dream of the rejuvenation of the Chinese nation,” which he has slated for consummation in 2049.

The CCP believes, furthermore, that the current international system impedes national rejuvenation by privileging the West. As a result, it is creating institutions—e.g., the Asian Infrastructure Investment Bank and the Shanghai Cooperation Organization—as alternatives to the Western-oriented institutions that have traditionally dominated the international system.

It is also prioritizing multilateral organizations, especially the United Nations, as useful forums for reorienting the international system. For instance, the CCP assiduously works to coopt the UN’s Human Rights Council to subvert the traditional understanding of human rights that is unflattering to Beijing, and to promote its own ersatz conception of rights. It even succeeded in inserting specific Chinese phrasing on human rights into resolutions adopted by the Council.

Africa is key to these efforts because it is the largest voting bloc in the UN, and many of its countries are becoming more skeptical of the Western-led international system. African governments increasingly voice their frustrations that interest rate hikes in the US make servicing their own dollar-denominated debt more expensive, that there are no permanent African members of the UN Security Council, or that ratings agencies unfairly downgrade their credit ratings, further driving up borrowing costs.

Some African states also see in Beijing a champion of the same type of repressiveness or undemocratic governance they themselves practice. This dynamic has existed for decades. Many African governments balked at condemning the Chinese military’s massacre of unarmed protesters in Tiananmen Square in 1989—in fact, the first foreign leader to visit China after the massacre was Burkina Faso’s long-serving autocrat Blaise Compaoré. As coups have recently proliferated across Africa and Western countries have responded with sanctions and other isolating measures, the number of governments that appreciate Beijing’s very different approach is growing.

African countries vote with Beijing at the UN at high rates, including on some of the most contentious issues like 2019’s cybercrimes resolution. They also on average comprise between 40 and 50 percent of the signatories to letters at the UN praising the Chinese government’s policies in Xinjiang, Hong Kong, and Taiwan. Many also often support Chinese candidates for leadership positions at the UN, participate in China’s Belt and Road Initiative, and back Beijing’s position on arcane matters like the proper method for resolving maritime disputes in the South China Seas.

This diplomatic support may well comprise the CCP’s single greatest interest in Africa, but it has other important ones as well. Chief among them is the continent’s great mineral wealth, specifically the minerals and metals that are central to emerging high-tech industries that have the potential to secure a country’s economic and political dominance.

Africa once provided around a third of China’s oil imports, but that figure has steadily slipped to around 10 percent today. China currently sources more oil from the Middle East, particularly Saudi Arabia, and, especially recently, from Russia (owing to Western sanctions, Russia sells oil to China and a few other customers at cut-rate prices.) Unsurprisingly, Russia and Saudi Arabia are, respectively, the second and third most important countries for China’s energy engagement since 2013.

Beijing’s “Made in China 2025” strategic plan prioritizes developing a variety of high-tech sectors, and Chinese enterprises now dominate the production or refining of many of the necessary key minerals, such as cobalt, lithium, rare earths elements, and manganese. China’s dominance is so comprehensive that it is the primary source for 7 of the 13 minerals most critical to the US, for which the US is 95 percent or more import reliant.

Chinese companies are preparing to continue and expand their dominance in the sector. In the first half of 2023, Chinese investment in metals and mining stakes grew by well over 100 percent year-on-year. Chinese firms currently have controlling stakes in nearly 50 mines outside of China that are under development or exploration for critical minerals.

Chinese activity in Africa’s mining sector reflects the broader trend. In 2000, there was only one operational mine—Dilokong in South Africa’s Limpopo Province—under Chinese control in all of Africa. Today, Chinese firms control at the high end around 8 percent of the value of Africa’s mining output. While that is significantly less than companies from traditional mining powerhouses like Canada and Australia, it represents a surge in Chinese mining activity in Africa over the last two decades.

Chinese mining activity in Africa is concentrated on certain key minerals and countries, demonstrating the strategic nature of the investments. Chinese state-backed banks’ financing of mining operations also furthers the strategy; a conservative estimate is that five Chinese mining operations in the Democratic Republic of the Congo alone reaped north of $120 billion in such financing. Chinese entities command about 25 percent of the DRC’s minerals and metals production, and have stakes in 15 of the country’s 19 cobalt-producing mines. They control about 12 percent of the value of Zambia’s mining production, nearly 40 percent of Guinea’s, about 25 percent of Gabon’s manganese production, and the Republic of Congo’s sole industrial mine, as well as all four of Eritrea’s. Finally, China is by a large margin the primary importer of African minerals, in 2020 buying 43 percent of sub-Saharan Africa’s mineral exports.

The Chinese Communist Party values Africa for many reasons, but the continent’s diplomatic importance and mineral wealth help explain why it engages the continent so intensively. This reality suggests that the Party’s preoccupation with Africa will persist as it continues its quest for national rejuvenation.