Will China’s launch of the digital currency electronics payment, or DCEP, the world’s first sovereign digital currency, threaten the ascendancy of the US dollar?

Beijing is hopeful and a growing group of policy thinkers in the American system are worried. If DCEP works, then the American ability to punish China or sanction its officials through denying them use or access to the greenback will be more inconvenient than devastating.

It might even help China eventually replace America as the centre of global finance. But the smart money is that even if DCEP is still in operation a decade from now, which is possible, China will still be grappling with its profound US dollar vulnerability and conundrum.

It is difficult to underplay the dominance of the US dollar. More than 60 per cent of global reserves and 90 per cent of foreign exchange transactions are in dollars. This compares to about 2 per cent for the renminbi, also known as the yuan, in both categories. These levels remain remarkably sticky despite the perceived rise of the Chinese economy and relative decline of America’s.

It is also easy to see why Beijing would like to change this global financial structure. About 60 per cent of its reserves are held in dollars and most of its external transactions are conducted in that currency. Currently, the alternatives are non-existent. For example, Beijing would need to increase its holdings of gold from about 3000 tonnes to 35,000 tonnes to replace its US dollar assets.

Moreover, the Chinese reliance on the dollar means that Beijing is vulnerable to the whims and wishes of American policies that might devaluate the greenback, thereby eroding the value of Chinese reserves.

Worst still for Beijing is the suite of devastating financial weapons available to Washington in a time of real crisis. This includes restricting the Chinese government, banks and entities from engaging in US dollar transactions or freezing dollar assets in their name.

an DCEP be a game changer? Its backers believe China is well positioned. Electronic transactions already account for four out of five payments, and there are more than 850 million mobile payment users and the number is rising rapidly.

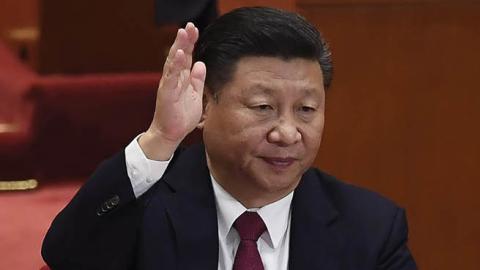

The DCEP system is being tried in a domestic market increasingly comfortable with using virtual currency and well on the way to becoming a cashless society. But the same reasons why the yuan is not a global currency despite China’s economic importance will hold back DCEP, and these obstacles will become even more problematic for China in the current Xi Jinping era.

The key characteristics for any currency to become truly global come down to trust and convertibility regardless of whether they are real or virtual, sovereign-backed or not.

Consider why the dollar retains its dominance despite the declining US share of global GDP. The greenback is fully tradeable on international foreign exchange markets. There are no capital controls restricting the purchase or sale of the dollar. With the deepest and most developed financial and debt market in the world, buying and selling the dollar is easy, efficient and transparent.

Contrast this with any real or virtual Chinese currency and its political economy. Given Beijing’s need to capture national savings and retain central control over China’s deployment and cost of capital, it is committed to a closed or heavily controlled capital account and cannot risk any fiat currency fleeing the country. Afraid of instability inherent to liberalised financial and currency systems, Beijing will not allow full convertibility of the yuan and is not planning to do so for any virtual alternative.

Indeed, like the yuan, DCEP will probably become a cheaper and faster way to trade directly with, or a means to invest in, China — and a useful currency for those seeking to escape the long arm of US sanctions. But that is very different to a Chinese virtual currency becoming a genuine store of value and as a way for governments — including in Beijing — and private entities to park and protect accumulated wealth.

It will not be lost on those seeking virtual alternatives that DCEP is partly being developed and rolled out as a way of breaking the duopoly on virtual transactions within the mainland enjoyed by Ant Group and Tencent, which have about 95 per cent of the market. Those overseeing DCEP are explicit that it will allow the regime to seize back control over private finance and enable the instantaneous monitoring of transactions, movements and behaviours of users. In other words, it is about unprecedented visibility and control afforded to the Communist Party and the shrinking of one’s private and confidential space. That is attractive for Xi and his subordinates, but not so much for most inside or outside China.

China might be ahead in the brave new world of sovereign virtual currencies and platforms to use these. But it has gone backwards when it comes to building trust in and liberalising its political economy. That, and not technology, will better determine whether the US dollar can be dethroned.

Read in The Australian