The Russian war on Ukraine has profoundly changed the calculus for energy security around the world. It created an acute need to replace Russian supplies of oil and natural gas, and now the United States and its allies recognize that they need to reduce their dependence on unreliable suppliers—be they Russian, Iran, Middle Eastern, or Central Asian producers.

The US has already achieved self-sufficiency in fossil fuels, which will most likely be the base of its energy requirements until at least 2050, although such self-sufficiency is a perishable good. It is a net exporter of crude oil and products and of natural gas. Maintaining self-sufficiency provides stability for domestic heating and transportation as well as numerous advantages for energy-intensive industries such as chemicals and heavy manufacturing.

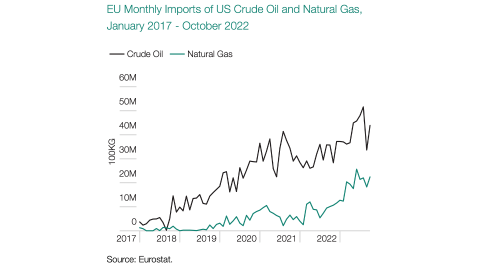

Nevertheless, the US now faces the challenge of helping allies in Europe and East Asia reduce their reliance on Russian and other unreliable suppliers. In 2022, the US managed to increase supplies sent to Europe (and to energy-poor allies on the Pacific Rim), which was enough to offset some of the worst supply and price shocks from the loss of Russian resources. Figure 1 shows that the US greatly increased oil exports and tripled liquefied natural gas (LNG) exports to Europe.

The US now features the largest installed capacity for LNG in the world. But to continue its role as the “energy arsenal of democracy,” it needs to further grow production of oil and gas while upgrading and expanding the infrastructure to get product to markets. This expansion is also important domestically, for instance, to get pipeline gas to New England from production-rich areas in the Mid-Atlantic. New permits for exploration and development are at the lowest level since the Truman administration, and the Biden administration has blocked or slow-walked expansion of the pipeline and processing infrastructure required to expand production and get it to market. The US has lost 5.4 percent of refining capacity for crude oil, with more shutdowns now being considered, contributing to higher domestic prices and a shortage of specialized products like diesel fuel. The administration’s emphasis on green technology and environmental, social, and corporate governance (ESG) investing has discouraged the financing of both domestic production and needed infrastructure. In contrast, the Biden team has worked to facilitate production in the Middle East and Venezuela, which are, along with Russia, the most environmentally destructive producers of oil and gas in the world.

In the longer run, the US has lagged behind China and other competitors in building capacity for renewable energy products. More than 80 percent of solar and 75 percent of wind products installed in the US are produced in China, Southeast Asia (often with parts from Xinjiang or other regions of China), or, for wind turbines, Europe. China also controls well over 80 percent of the production and processing of rare earths and other minerals (e.g., cobalt, lithium, graphite, and nickel) used for electric vehicles, storage batteries, solar panels, and wind turbines. The US has been largely passive as China has bought mines in Africa, South America, Canada, and Australia, which produce and process these materials.

The US has been and remains a leader in nuclear generation technology. Several innovative US companies are perfecting the newest generation of smaller, modular reactors, even though permitting new plants remains difficult. America does have huge domestic resources of uranium, but it has allowed the mining and processing of this mineral to migrate to foreign suppliers. Ninety percent of the enriched uranium used in US plants is imported, and 49 percent comes from Russia or nearby allied states in Central Asia. The US no longer has an operating enrichment plant. Permitting for new mineral mines in the US normally requires 15 or more years, making financing extremely difficult.

If the US is to continue its short-term role as swing producer of crude oil and natural gas and build out future security in renewables production, it will have to adopt a much more production-oriented policy, including for mining, processing, and infrastructure development. It will also have to rethink its policies, such as promoting ESG investing and aggressively discouraging fossil fuel and mining development. Such efforts are necessary because Russian aggression against Ukraine teaches us that we do not want to rely upon Russia or China for nuclear fuel, basic renewable energy minerals, processing, or final products.