Related Events

10

March 2026

In-Person Event | Hudson Institute

US-Japan Cooperation on Naval Maintenance, Commercial Shipbuilding, and Shipping

Featured Speakers:

Akira Fukaishi

Diana Maurer

Michael Roberts

Kyoko Imai

Moderator:

William Chou

10

March 2026

In-Person Event | Hudson Institute

US-Japan Cooperation on Naval Maintenance, Commercial Shipbuilding, and Shipping

Join Hudson for a discussion highlighting each nation's approach to these common challenges, as well as how US-Japan collaboration should best proceed.

Featured Speakers:

Akira Fukaishi

Diana Maurer

Michael Roberts

Kyoko Imai

Moderator:

William Chou

11

March 2026

In-Person Event | Hudson Institute

Mobilize: How to Reboot the American Industrial Base and Stop World War III

Featured Speakers:

Walter Russell Mead

Shyam Sankar

11

March 2026

In-Person Event | Hudson Institute

Mobilize: How to Reboot the American Industrial Base and Stop World War III

With Walter Russell Mead, Sankar will discuss his strategy to resurrect the American industrial base, win the twenty-first-century defense technology race, and prevent World War III.

Featured Speakers:

Walter Russell Mead

Shyam Sankar

16

March 2026

In-Person Event | Invite Only

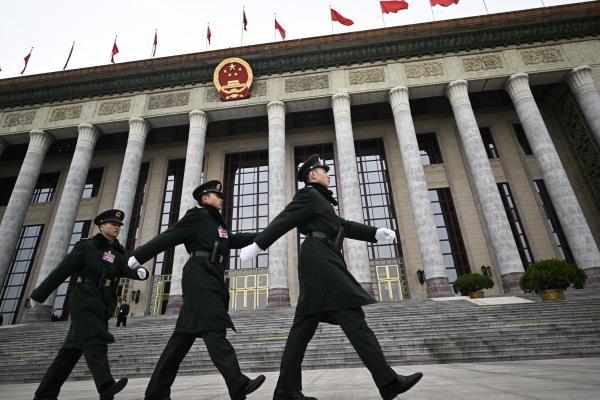

Prioritizing Political Prisoner Advocacy Across China

Featured Speakers:

Grace Jin Drexel

Olivia Enos

Gao Pu

Corey Jackson

Michael Kovrig

Ziba Murat

Pedro Pizano

Moderators:

Olivia Enos

Michael Sobolik

16

March 2026

In-Person Event | Invite Only

Prioritizing Political Prisoner Advocacy Across China

Join us at Hudson Institute to discuss how advocates, lawmakers, and the US government can prioritize the release of political prisoners across China.

Featured Speakers:

Grace Jin Drexel

Olivia Enos

Gao Pu

Corey Jackson

Michael Kovrig

Ziba Murat

Pedro Pizano

Moderators:

Olivia Enos

Michael Sobolik

18

March 2026

In-Person Event | Hudson Institute

Killed to Order: China’s Organ Harvesting Industry

Featured Speakers:

Nina Shea

Jan Jekielek