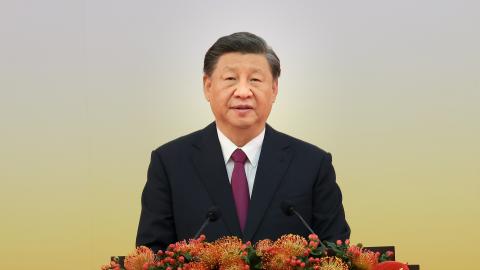

As Covid lockdowns and buyers’ revolts roil China’s real-estate market, Xi Jinping is attempting to ride a tiger—to maintain power while clinging to the foolhardy policies that put him in this position. But as a Chinese central banker said of the country’s real-estate bubble, the problem with riding a tiger is that if you fall off, the tiger eats you. What are the odds Mr. Xi ends up in its jaws?

China’s growth has been ravaged by Mr. Xi’s draconian Covid lockdowns. Last month Beijing announced the slowest annualized economic growth rate since the Covid crash: only 0.4% in the second quarter, down 2.6 percentage points from the first quarter. Services contracted by 0.4%. Youth unemployment was a record 19% in June.

In many respects China’s domestic growth trend is its weakest since the final days of Mao Zedong, with year-over-year retail sales declining by 11% in April and 7% in May before rebounding slightly in June, consumer confidence and domestic consumption falling, and both dollar and renminbi high-yield bonds at or near record lows. China’s only remaining bright spot is exports.