I. Introduction

In 2006, the Supreme Court changed the landscape of patent law with its decision in eBay v. MercExchange,1 creating a new test for injunctions that significantly altered this longstanding remedy for patent infringement. Injunctive relief for patent infringement was no longer certain. In fact, some patent owners could be almost certain that they would not be granted a permanent injunction against an infringer, with courts instead setting “ongoing royalties” for the continuing infringement. Infringers, knowing that they are unlikely to be enjoined, are—in certain cases—taking the risk to “infringe now, pay later.” This mindset is known as predatory infringement.2

As the twentieth anniversary of this landmark opinion looms, evidence of a more insidious fallout from eBay is accumulating. Not only does the lack of injunctive relief no longer serve as a deterrent to infringement, but it also negatively impacts the functioning of efficient markets and negotiations of fair market value. As economists have long explained, injunctions are the legal means by which property owners are able to set terms in commercial negotiations that result in business deals and other economic activities in the innovation economy. Specifically, when an injunction is available, a patent owner, like any other property owner, can say during the course of negotiations, “No, I will not license my patent to you at the price you are offering to me.” Parties who wish to use the patented technology will either need to pay the patent owner’s asking price or will need to opt for different technology.

In contrast, where an injunction is not available, parties who wish to use the technology have no need to negotiate in good faith—or at all. These parties can coerce a “compulsory license” to use the technology through predatory infringement, having only to accept whatever “price” is set after the fact by courts or regulators. Of course, not all parties will be willing to infringe, whether due to an ongoing relationship with the patent owner or reputational concerns. However, this lack of injunctive relief leads to a distorted market in which patents are devalued as an asset class.

While this could be considered simply a side effect of predatory infringement, it is actually a more significant problem. The lack of injunctive relief is harming patent owners even where predatory infringement is not occurring; the value of all patents is diminished because the lack of injunctions alters licensing negotiations. Most patent licensing occurs in secret, so it is difficult to measure the harm that eBay has caused in this respect. However, a recent study conducted by AUTM (known previously as the Association of University Technology Managers) provides an insight into the eBay effect: exclusive licenses, which are generally higher-valued, have decreased while non-exclusive licenses, which are generally lower-valued, have increased in the years since the eBay decision. This is evidence of how the loss of injunctions, resulting in a zero value for exclusivity in a license deal, has negatively impacted commercial transactions and devalued patents generally.

Before presenting this important data, this policy memo first explains the law of injunctions for patent infringement, both before and after eBay. It then details the evidence of how eBay has resulted in courts issuing fewer injunctions against infringers of patents. Many policy analysts and commentators focus only on this litigation data and stop there, but this legal fact matters because of its negative impact on markets for technology and the innovation economy. The policy memo thus describes how the lack of injunctive relief is negatively impacting the ability of patent owners to successfully negotiate high-valued licenses in the marketplace. Policy discussions about eBay and injunctive relief must account for the economic function of injunctions— how this remedy for infringement facilitates the commercial transactions that grow the innovation economy and create jobs.

II. Permanent Injunctions Before and After the eBay Decision

Injunctive relief upon a finding of patent infringement stems from the constitutional grant of power to Congress to secure “the exclusive right” to “inventors” for their “discoveries.”3 This right to exclude, as the Supreme Court has acknowledged, is “the essence of a patent grant.”4 It is what makes a patent a property right. In recognition of this essential right, prior to eBay, if courts found a valid patent to have been infringed by a defendant, they presumptively granted an injunction in nearly all cases.5 After eBay, however, things have been quite different.

Although the eBay decision is nearly eighteen years old, it is worth reviewing the opinion given that the most oft-cited portion is not the majority opinion, but a concurrence by Justice Anthony Kennedy. The patent in the eBay case was owned by MercExchange, a company that did not directly manufacture or sell anything secured by its property right.6 MercExchange was a failed startup; when it could not succeed in starting a manufacturing enterprise, it instead licensed its patented technology to others.7 The internet auction site eBay was using MercExchange’s patented technology without a license, and MercExchange sued for patent infringement. Although eBay tried to invalidate the patent in defending itself in court, it was unsuccessful. The trial court held that MercExchange’s patent was valid and that MercExchange had proven that eBay infringed. The court granted MercExchange a substantial damages award,8 but denied MercExchange’s request for a permanent injunction because MercExchange did not manufacture the technology itself; it only licensed the technology to other companies.9 MercExchange appealed to the Federal Circuit, which affirmed the trial court’s finding of validity and infringement, but reversed the trial court’s denial of MercExchange’s request for an injunction.10 eBay then petitioned the Supreme Court to reverse the Federal Circuit and reinstate the denial of the injunction.

The Supreme Court unanimously reversed the Federal Circuit.11 In a very short opinion, the Court stated that categorical denials of injunctive relief (as the district court had done in this case) and blanket grants of injunctive relief (as was the Federal Circuit’s practice) were both in error.12 Instead, the Court set forth a four-factor test that courts should use to decide whether to grant a permanent injunction. This test requires the party seeking a permanent injunction to demonstrate “(1) that is has suffered an irreparable injury; (2) that remedies available at law, such as monetary damages, are inadequate for that injury; (3) that considering the balance of hardships between the plaintiff and defendant, a remedy in equity is warranted; and (4) that the public interest would not be disserved by a permanent injunction.”13 These factors are to be balanced and each particular case should be decided on its merits.14 This four-factor test has been the subject of significant legal debate focused on its history and legitimacy, which is beyond the scope of this memo but has been covered extensively elsewhere.15

Although the majority opinion is rather clear that categorial grants or denials of injunction are incongruous with its four-factor test, the eBay case spawned two concurring opinions in the Supreme Court. One, authored by Chief Justice John Roberts and joined by Justices Antonin Scalia and Ruth Bader Ginsberg, stated that although automatic grants of injunctive relief are inappropriate, the historical case law confirms that a patent’s exclusionary right means that injunctions have been predictably granted in almost all cases.16 As with all property rights, the loss of an exclusive right has long been held by courts to create a presumption of irreparable harm, or a harm that cannot be remedied by damages alone.

The other concurrence, written by Justice Kennedy and joined by Justices John Paul Stevens, David Souter, and Stephen Breyer, embraced policy arguments, not historical case law or judicial practices in remedying patent infringement. Justice Kennedy focused on a number of controversial policy concerns and other supposed perils in patent law that would counsel against the grant of an injunction despite a finding of infringement of a valid patent.17 These included patent trolls,18 business method patents,19 or single consumer devices that include a large number of patented components held by different patent owners.20 Justice Kennedy concluded that in all these circumstances, a court should be wary about granting any injunctive relief.21

As has been widely recognized by commentators, the Justice Kennedy concurrence is often (and erroneously) cited as the holding in eBay. The Chief Justice Roberts concurrence is generally ignored. Interestingly, the concurrence of Chief Justice Roberts is the opinion most aligned with history and precedent. While the majority opinion called for an application of “historical” equitable doctrines, it fails to mention, as the Roberts concurrence does, that traditionally, in patent cases, injunctions would nearly always be issued as a remedy for patent infringement.22

The reason for this is that a patent is a property right—an exclusive right. As with all property rights, such as when someone trespasses on someone’s land—or, as in one famous property case, a trespasser cut down a landowner’s trees without permission23—the property owner has lost the right of exclusive control over his or her assets.24 This loss of control—in patent law, the loss of the right to exclude others from using the patented technology—creates a presumption of irreparable harm. That presumption of irreparable harm means the patent owner should receive an injunction, unless the defendant can assert and prove other legal claims that weigh against injunctive relief. In legal terms, the presumption of an injunction is not automatic, because it is rebuttable by the defendant.

After eBay, none of this historical case law on injunctions has been applied by courts in patent infringement cases. They have instead focused narrowly on Justice Kennedy’s alleged policy concerns in the concurring opinion. The result is that courts generally decline to issue injunctive relief in certain cases. Patent owners who license their property rights have been denied injunctions most often, but even manufacturing companies are now denied injunctions at higher rates than before eBay.25

The problem does not solely lie with the Supreme Court and the district court judges who have mistakenly followed the Kennedy concurrence. The Federal Circuit, which has jurisdiction to hear all appeals in patent infringement cases, made injunctive relief even more difficult to obtain in 2011 in Robert Bosch v. Pylon Manufacturing.26 Prior to the Bosch decision, the Federal Circuit had stated that “where validity and continuing infringement have been clearly established, immediate irreparable harm is presumed.”27 This is in accord with historical case law in patent law and for injunctive relief for property rights. In Bosch, however, the Federal Circuit concluded that eBay “jettisoned the presumption of irreparable harm as it applies to determining the appropriateness of injunctive relief.”28 This was mistaken, if only because eBay said nothing about the presumption of irreparable harm, remarking only that categorical or automatic rules do not apply to the issuance of injunctions. In fact, rebuttable presumptions are not automatic, categorical rules and thus do not run afoul of eBay’s prohibition on such rules. The further misinterpretation of eBay in the Bosch decision made it even more difficult for all patent owners to obtain injunctive relief against a defendant found to be infringing a valid patent.

III. The Negative Impact of eBay on Rates of Injunctions for Patent Infringement

Given the Supreme Court’s exhortation in eBay that injunctive relief should not be automatically granted to stop patent infringement, the outsized focus on the policy arguments in the Kennedy concurrence, and the Federal Circuit’s mistaken understanding that irreparable harm cannot be presumed when a valid patent is infringed, it is no surprise that the granting of injunctions has become significantly less reliable following eBay.

Initial studies of the effect of eBay focused on litigation and the impact on the change in the granting of an injunction for infringement of a patent. Prior to eBay, permanent injunctions were granted in most cases.29 Studies support this, finding injunctive relief was granted in 94–100% of cases where patent infringement was found.30 After eBay, however, this number took a drastic downturn. Studies done in the first decade after eBay found that requests for permanent injunction were denied in approximately one-quarter of cases where patent infringement was established.31

In a widely cited study covering the time period between the eBay decision in May 2006 and December 2013, Professor Christopher Seaman found that requests for permanent injunctions were granted in 72.5% of cases, representing a marked decrease “from the state of play before eBay, when injunctions were granted to prevailing patentees in almost all cases.”32 Another study by Professor Jay Kesan and Kirti Gupta similarly found a statistically significant decrease in injunctions being granted on a finding of infringement of a valid patent; even more important, they found a decrease in courts awarding injunctions to both licensing and manufacturing companies after defendants were found to liable for patent infringement. 33 These studies need to be updated, but they still confirm that eBay had a profound, negative effect on the availability of an injunction as the rightful remedy for patent infringement. This negative effect is even more pronounced for plaintiffs who are patent licensing companies, the patent owners specifically called out as illegitimate in Justice Kennedy’s concurrence, which confirms again the mistaken focus on Justice Kennedy’s concurrence as representing the holding of eBay.34

IV. The Negative Impact of eBay on the Innovation Economy

An injunction is not merely a remedy ordered by a court against someone found liable for violating a property right such as a patent. When property owners lose the ability to say “no” when faced with the unauthorized access or use of their property, common sense says that infringement will become more common and commercial transactions more difficult and protracted.35 In patent law, this is now known as “predatory infringement,” in which defendants choose a commercial strategy of “infringe now, pay later,” at worst, or, at best, they get away with infringement through a lengthy legal battle of attrition in which the patent owner ultimately just gives up. The existence of predatory infringement is difficult to measure; yet, the simple idea that reduced legal protection may result in predatory infringement is being confirmed by some empirical studies.36

Common sense also tells us that the loss of injunction to stop violations of property rights also devalues property in the marketplace—it is simply worth less given that it offers less protection to its owner. This is a basic idea in economics. The exclusive nature of property is the key to efficient use of assets. Exclusion means an injunction. An injunction is the legal backstop for commercial negotiations—it is the protection that secures to any property owner the freedom to say “no” to an offer to purchase or access one’s property. In patent law, an injunction allows a patent owner to walk away from negotiations if the party wishing to use the patented technology is unwilling to pay the asking price. But where an injunction is unlikely to be granted, that third party has little-to-no incentive to negotiate a license and instead may choose the “infringe now, pay later” strategy of predatory infringement.

Even when a company chooses to follow ethical practices and properly purchase a license—pay for the rights to use the invention—the lack of injunctive relief necessarily means that the patent is worth less in this commercial transaction. The licensee is purchasing fewer rights, because the right to exclude is no longer one of the rights that the patent owner can offer for sale. This legal and economic logic has now been confirmed by an empirical study.

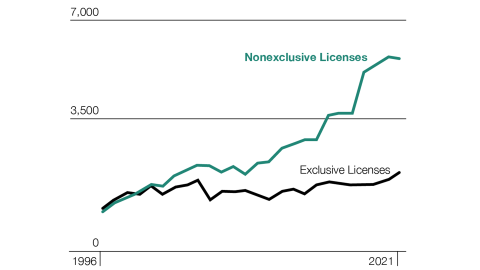

In a recent study, AUTM reviewed university patent licenses with companies between 1996 and 2021, looking at whether a company purchases an exclusive or nonexclusive license. Understandably, an exclusive license is a higher-valued transfer of property rights, because the buyer is the only person legally allowed to use and commercially benefit from the patented technology. In legal and economic terms, an exclusive license is the transfer of the exclusive right to make, use, or sell something—it is the sale of the entire property right—and so it is worth more to the buyer. Nonexclusive licenses are generally lower-valued assets and cost less because the technology is made available to multiple parties that are in competition with each other in the marketplace.

Figure 1. AUTM US Licensing Activity Survey: 1996–2021

As figure 1 illustrates, prior to the eBay decision in 2006, the amount of exclusive licensing and nonexclusive licensing was very similar. After 2006, nonexclusive licensing grew significantly, while exclusive licensing dropped off or remained stagnant. In fact, since approximately 2011, the time of the Federal Circuit Bosch decision, the relative rate of nonexclusive licenses has skyrocketed compared to the rate of exclusive licenses.

Though overall licensing activity has increased over the period studied by AUTM, the growth is almost entirely attributable to nonexclusive licenses. Again, a nonexclusive license is one in which the right to exclude—the right secured by an injunction—is not purchased by the licensee. Following eBay and Bosch, as confirmed by the empirical studies, injunctions are metaphorically off the table, which means exclusion is no longer a term available for purchase from a patent owner by a licensee. What economically rational company would pay more for something that the patent owner no longer possesses and thus cannot sell? To apply here the classic cliché about someone trying to sell something they don’t own: if a patent owner offers an exclusive license today, it’s trying to sell you the Brooklyn Bridge.

The AUTM data is an initial empirical insight into the negative commercial effects of the loss of injunctions as a remedy for patent infringement. It requires more study and analysis based on rigorous statistical methods. However, it provides support for the supposition that eBay not only has fostered the practice of predatory infringement, but has devalued patents as commercial assets generally. Exclusion is no longer one of the terms a patent owner can offer for sale in a license. Where an injunction is unavailable, patents have become less valuable—and that is a very big problem because it reduces the ability of patent owners to obtain returns on their investments that drive growth in the innovation economy.

V. Future Directions

Injunctive relief for patent infringement should be restored. This remedy for violations of all property rights serves both as a deterrent to patent infringement and facilitates market transactions in which fair market value is set through commercial negotiations. The preliminary data demonstrates that patents are being devalued following eBay. Additional, rigorous studies should be done, but this preliminary data supports anecdotal reports and related studies about predatory infringement that the loss of injunctions is causing harm.