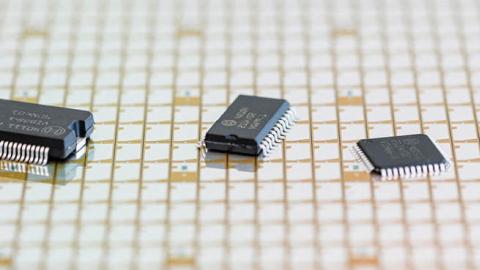

America’s economy is built on microelectronics, but the chip shortages and security failures roiling industries from automobiles to game consoles show that U.S. semiconductor supplies are neither resilient nor assured. New U.S.-based chip fabrication or packaging plants, however, would be hard-pressed to compete against experienced foreign rivals such as Taiwan’s TSMC or Korea’s Samsung that have strong customer relationships, lower labor costs, and tax breaks, subsidies and regulatory relief from their governments.

To level the playing field, Congress authorized federal investment in U.S. semiconductor production this year through the CHIPs Act. Now lawmakers are considering funding CHIPs via the U.S. Innovation and Competition Act of 2021, which would allocate almost three-quarters of its $50 billion toward building and equipping fabrication and packaging plants for current generation chips. Unfortunately, this approach will not produce competitive U.S. microelectronics, fails to exploit corporate or other private capital, and would put the U.S. microelectronics industry at a disadvantage over the long term.

A more effective and sustainable microelectronics strategy would flip the Innovation and Competition Act’s priorities and invest the bulk of CHIPs money in future technologies. While the proposed bill allocates a relatively paltry $13 billion to research and development (R&D) over the next five years, TSMC alone plans to spend $6.3 billion on technology development during 2021. By exploiting the ongoing transition in chip design from simply growing circuit density to instead adopting increasingly complex architectures, government R&D funding could help the U.S. microelectronics industry meet future demand and gain an enduring advantage over foreign competitors.

To commercialize new technologies that are about five to 10 years from market, the government should deploy much of its semiconductor R&D funding through mechanisms that can tap into private capital and expertise, such as the National Semiconductor Technology Center public-private partnership established by the CHIPs Act. These ventures can accelerate across the “valley of death” technologies such as disaggregated and heterogeneous circuit designs and associated manufacturing and packaging techniques, moving the U.S. microelectronics industry up the value chain ahead of overseas rivals. In addition to offering greater specialization and performance compared to today’s predominant designs, disaggregated semiconductor architectures like systems on a chip can improve security assurance because the final configuration of the microelectronics package could be obscured until final assembly.

For microelectronics technologies 10 to 20 years from commercialization, a new strategy’s emphasis on R&D would provide greater government support to basic and applied research in approaches such as low-power digital integrated circuits, novel semiconductor materials, and new computing approaches with disruptive potential for future consumer markets. Because of their higher risk and more distant returns, these next-generation technologies will depend on government sponsorship but are essential to enabling U.S. chip makers and packagers to continue moving up the value chain and sustaining a lead they could establish in the near term through public-private partnerships.

To improve the resilience and assurance of today’s U.S. chip supply chain, the new strategy’s second line of effort would use government funding and policy to catalyze expansion of U.S. semiconductor fabrication and packaging capacity. Government money would not be used for building and outfitting new plants, but instead would focus on closing the operating cost differential between U.S. and overseas production through a combination of tax and regulatory incentives. As a result, the business case for new facilities would be improved, which should unlock private funding for facility construction and equipment.

But even with equal operating costs, U.S. chip makers and packagers will remain behind TSMC and Samsung in experience and customer relationships. Therefore, the strategy also would require that foreign chip makers partner with U.S. firms when building facilities in the United States, as U.S. allies have done for decades.

At the end of the day, the U.S. microelectronics industry is unlikely to win a race to the bottom on cost against committed foreign rivals. It must move to higher-value semiconductors. With the Innovation and Competition Act, Congress has an opportunity to steal a march on overseas competitors by exploiting the transition from increasingly dense chips to new designs that offer specialization, performance and security. However, this opportunity will be missed if federal microelectronics investment goes primarily to building uncompetitive chip plants instead of using government funds to unlock the private market’s potential.

Read in The Hill