WASHINGTON--More Americans are turning to the Internet to shop this holiday season, buoyed in part by the lure of what they believe to be tax-free shopping. Because of a loophole in federal law that pre-dates the Internet, the traditional "brick and mortar" store is under economic siege by a variety of out-of-state sellers who are not required to collect state sales taxes.

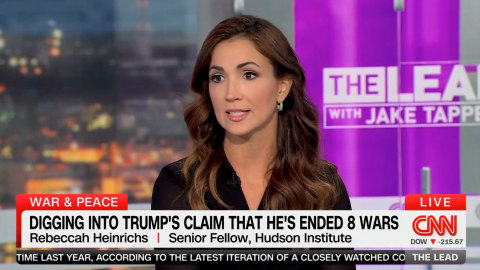

A new report from Hudson Institute, entitled Future Marketplace: Free and Fair, finds that the sales tax loophole is equivalent to a subsidy, distorting the free market by providing an incentive for one form of economic activity over another.

The report, authored by Hudson Visiting Fellow Hanns Kuttner, says up to $330 billion in annual sales will be subject to government special treatment for online, out-of-state sellers in 2012.

"As more people shop online, local businesses that are put at a competitive disadvantage by the government will lose," says Kuttner.

Click here to download the full report.